Debt optimization

Optimize your debt-to-income ratio for a mortgage

A low debt-to-income (DTI) ratio enhances your mortgage borrowing capacity. Lenders see a lower DTI as a sign of financial stability, which increases your chances of approval for larger loan amounts and more favorable interest rates.

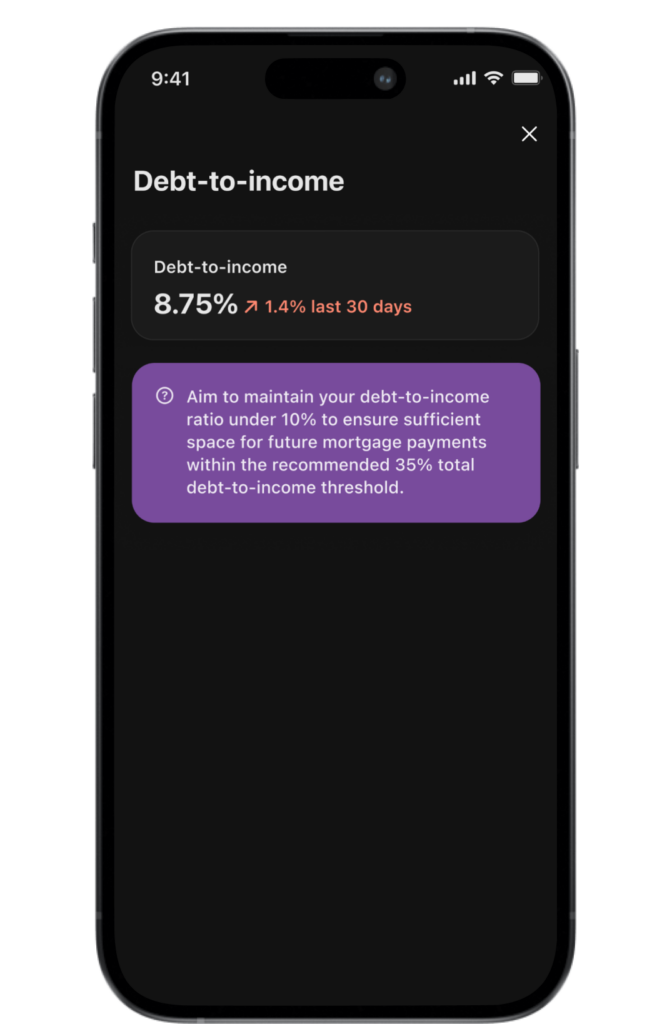

Track your current debt-to-income ratio

Connect your credit report and get a clear understanding of your total monthly payments (credit cards and loans).

Receive recommendations to reduce your debt

Our home buying and financing experts will provide you with the guidance you need to reduce your debt.

See the impact of your DTI on your home buying project

Your current DTI is automatically taken into account in your home buying plan and reflected in your buying power.